Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

Monday, May 28, 2012

NIFTY NEXT- Nifty Trading Range for 28 May 2012

Nifty-Spot today ( 28 May 2012) will Trade with Positive to Flat/Negative and then it will Try to Bounce-Back From its lower levels and it will Trade within the Range of 4930-4879.Nifty-Spot will find Huge Resistance at its 15DMA (4926.53).As per Our NNI-Nifty Next Indicators, which has also declined in Last Trading Sessions, also Suggests the Same Pattern for Nifty-Spot. On Technical Price Chart, Major Momentum Indicators are Started Gaining Momentum .If Index closes above 4937, then a Bullish Trend will Start for Short Term. Banking Stocks will be Today(28 May 2012) Traders’ Picks.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based quant Research Firm, M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks, trades at NSE. You can reach the Chartist here mail@niftynext.com . We are Using Ami Broker Charting Software ( V-5.51 ) ,Pattern Explorer & Ami Tool-Power Scan.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT-TOP 8 STOCKS FOR 28 MAY2012

| STOCKS/SCRIPS™ WWW.NIFTYNEXT.COM | TRENDS |

| SBIN | |

| ICICIBANK | |

| AXISBANK | |

| TATASTEEL | |

| BHEL | |

| ITC | |

| JPASSOCIAT | |

| INFY | |

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

Friday, May 25, 2012

NIFTY NEXT- Nifty Trading Range for 25 May 2012

Nifty-Spot today(25 May 2012) will Trade with Negative to Positive Note within the Range of 4898-4944.As per Our NNI-Nifty Next Indicators, which has gained huge in last Trading Session on 24 May 2012, suggests that Nifty Will Trade with Positive Bias on 25 May 2012 and it Bounch-BaCK From Its lower level today. On Technical Price Chart, Nifty is looking Strong and Gaining Momentum. Above levels are very crucial in nature for Index.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based quant Research Firm, M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks, trades at NSE. You can reach the Chartist here mail@niftynext.com . We are Using Ami Broker Charting Software ( V-5.51 ) ,Pattern Explorer & Ami Tool-Power Scan.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- GOLD Price Target and Technical Chart

GOLD-I ended at 28880 at MCX on 24 May 2012 with a Fall of -0.30% with formation of a Black Candle. On Daily Price Chart , GOLD-I is showing Weakness. It may Slide further to 28839/28166 in coming 5-10 Days. Selling GOLD-I with Stop-Loss at 28901/28995 is Advisable.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- INDIAN RUPEE Technical Chart 25 May 2012

Indian Rupee is now Trading at `55.65 against US Dollar with a Gain of +0.10%.It has now Strong Support level at `55.21

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

Thursday, May 24, 2012

NIFTY NEXT- Nifty EOD 24 May 2012 Technical Analysis & Out Look For 25 May 2012

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- Nifty Trading Range for 24 May 2012

Nifty-Spot today will Trade with Positive to Flat or Negative Note within the Range of `4861-4816. As per Our NNI-Nifty Next Indicators, which has Declined in Last Trading Session on 23 May 2012, suggests that Nifty will Find hard to sustain at its higher levels and May Slide from these Higher levels of `4859/4861 and may find Support around 4816 on Intraday Basis on 245 May 2012. On Technical Price Chart, Nifty is Still Trading Below its 200DMA, making its Bearish and Major Momentum Indicators are also looking Bearish in Nature. `4816 & 4861 are very crucial for Nifty on 24 May 2012.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

COALINDIA-A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

COALINDIA Closes at `308.35 with a Gain of +0.80% on 24 May 2012 with formation of a White Candle on Daily Price Chart .Technically, COALINDIA is looking Strong on Charts and it is Trading Below its 200DMA. Major Momentum Indicators are also Bullish on Daily Price Chart.

We Recommend to BUY: COALINDIA Above` 311.

Target : `339.50S Sto

Stop: Loss :`298.50

Time Frame: 5-15 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 Or SMS at +91 880 2230 836/ 8927670565.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

RANBAXY -A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

RANBAXY Closes at `501.05 with a Gain of +1.60% on 24 May 2012 with formation of a Long White Candle on Daily Price Chart .Technically, RANBAXYL is looking Strong on Charts and it is Trading Above its 200DMA. Major Momentum Indicators are also Bullish on Daily Price Chart.

We Recommend to BUY: RANBAXY at CMP

Target : `544.85S Sto

Stop: Loss :`490.40

Time Frame: 5-15 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 Or SMS at +91 880 2230 836/ 8927670565.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

BHARTIARTL-A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

BHARTIARTL Closes at `282.10 with a Fall of -4.40% on 24 May 2012 with formation of a Long Black Candle on Daily Price Chart .Technically, BHARTIARTL is looking Bearish on Charts. Major Momentum Indicators are also Bearish.

We Recommend to SELL: BHARTIARTL at Below `278.31 CMP ` 384.53

Target : `254.00S Sto

Stop: Loss :`287.70

Time Frame: 5-15 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 Or SMS at +91 880 2230 836/ 8927670565.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

GAIL-A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

GAILCloses at `324.75 with a Gain of +1.20% on 24 May 2012 with formation of a Long White Candle on Daily Price Chart .Technically, GAIL is looking Strong on Charts. Major Momentum Indicators are also Bullish.

We Recommend to BUY: GAIL at CMP

Target : `334.20/361.40S Sto

Stop: Loss :`307.00

Time Frame: 5-15 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 Or SMS at +91 880 2230 836/ 8927670565.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- Dow Jones Industrial Average (^DJI) Technical Price Chart 24 May 2012

Dow Jones Industrial Average ended at 12498.60 with a gain of +1.20% on 24 May 2012.On Technical Price Chart, Major Momentum Indicators are gaining Strength. ^DJI has now Strong Resistance at 12594.80/13182.20 and Strong Support at 12303.20.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- INDIAN RUPEE 5 Mins Technical Price Chart 24 May 2012

Indian Rupee is now Trading at `55.95 against US Dollar with a Fall of -0.30% in Early Trades on 24 May 2012. As per Technical Price Chart, Indian Rupee has Strong Support at `55.8557 and Resistance at `56.4474 against US Dollar. Trading above `56.4474 will Make the Indian Equity Market More Vulnerable.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

Wednesday, May 23, 2012

NIFTY NEXT- INDIAN IS now Trading at `55.95 against US Dollar

Indian Rupee is now Trading at `55.95 against US Dollar on 23 May 2012 with a a Weakness of -1.10%. On Technical Price Chart, Indian Rupee is looking more Sluggish and may Slide Further to the level of 56.04. This Weakness in Indian Rupee will mark the Start of Slide in Indian Equity Market further.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- Nifty EOD 23 May 2012 Technical Analysis & Out Look For 24 May 2012

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- Nifty Trading Range for 23 May 2012

Nifty-Spot today(23 May2012) will Trade with Flat to Negative note within the Range of 4948-4822. As per our NNI-Nifty Next Indicator, which has declined in last Trading Session on 22 May 2012, also suggests the Same Trading Bias, that is Nifty Will find Strong Resistance at Higher levels and will See Selling at these Higher levels of 4850. As per Technical Price Chart, Major Momentum indicators are looking Bearish. As per Regression Line concept, Nifty will Goes into a Bearish Phase if it Closes below 4822.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based quant Research Firm, M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks, trades at NSE. You can reach the Chartist here mail@niftynext.com . We are Using Ami Broker Charting Software ( V-5.51 ) ,Pattern Explorer & Ami Tool-Power Scan.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

AmiQuote 3.03 released on MAY 22, 2012

CHANGES FOR VERSION 3.03 (as compared to version 3.02)

- added “Max days” edit to control maximum intraday backfill length. Specifying lower than maximum allowed days results in faster download and less data to transfer. Google Intraday supports 1..15 max days for 1-minute bars and 1..60 max days for 5-minute bars. Yahoo Intraday supports only 1-day of 1-minute bars and only 1 and 5 days of 5-minute bars. Specifying other combinations (such as 2, 3 or 4 max days for 5-minute bars) for Yahoo results in retrieving all 5 days.

IMPORTANT:

AmiQuote is nothing but specialized web browser/downloader. You are using 3rd party web pages/services (Yahoo/MSN/Google/Finam) available to the public and AmiQuote acts like Internet Explorer or Firefox. The availability of data/web pages depends on those 3rd parties and may change in the future. The financial data downloaded from public web sites such as Yahoo Finance/MSN/Google/Finam are for personal use only. Consult 3rd parties’ Terms of Service for details. For actual trading we recommend using paid data sources that provide higher data quality and reliability.

Source www.amibroker.com

Tuesday, May 22, 2012

NIFTY NEXT- Nifty EOD 22 May 2012 Technical Analysis & Out Look For 23 May 2012

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- Nifty Trading Range for 22 May 2012

Nifty-Spot today will Trade with Gap-Up to Negative/Flat within the Range of 4983-4949 on 22 May 2012. As per Our NNI-Nifty Next Indicator, which has seen huge Fall in its Value, suggests that Nifty May Find Resistance at Higher levels and may see Selling at these Higher Points today. On Technical Price Chart, Nifty is Gaining Momentum for Higher Move and formation of Base is on. Trading with Caution is advisable at this point. Avoid Bull’s Trap Now.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based quant Research Firm, M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks, trades at NSE. You can reach the Chartist here mail@niftynext.com . We are Using Ami Broker Charting Software ( V-5.51 ) ,Pattern Explorer & Ami Tool-Power Scan.

Call NiftyNext # +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

Monday, May 21, 2012

NIFTY NEXT- Nifty EOD 21 May 2012 Technical Analysis & Out Look For 22 May 2012

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- Nifty Trading Range for 21 May 2012

Nifty-Spot today(21 May 2012) will Trade with Negative to Flat or Positive note within the Range of 4868-4923. As per Our NNI-Nifty Next Indicators, which has gained in Last Trading Sessions also suggests the Same Trading Pattern for Nifty . On Technical Price Chart, Nifty is at at very crucial Stage. Few Momentum Indicators has given Positive Signal for Index. If Nifty-Spot Trades/Closes above 4937, then the Bulls will have Upper Hand and if it Closes below 4832, then We may See Steep Fall In Index in coming Days.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based quant Research Firm, M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks, trades at NSE. You can reach the Chartist here mail@niftynext.com . We are Using Ami Broker Charting Software ( V-5.51 ) ,Pattern Explorer & Ami Tool-Power Scan.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

Friday, May 18, 2012

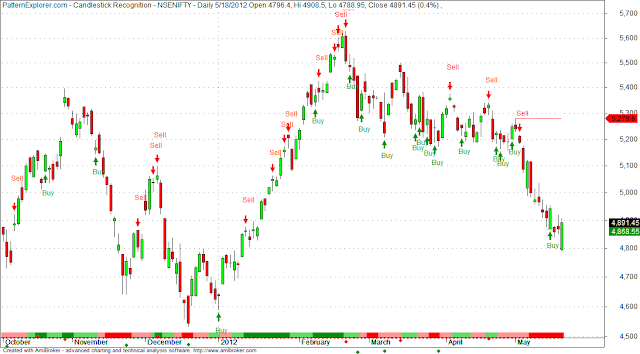

NIFTY NEXT- Nifty Trading Range for 18 May 2012

Nifty-Spot today will Open with a Gap-Down and will Trade with Negative Note within the Range of `4784-4827.As per our NNI-Nifty Next Indicator, which has declined by Huge Value in Last Trading Sessions, suggests the same Bearishness. On Daily Price Chart of Nifty, Major Momentum Indicators are still in Bearish Zone. If Nifty-Spot today closes below `4827, then the Index is moving towards Mid-Term Bearish Phase and may further Decline to the level of ` 4739/4509.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based quant Research Firm, M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks, trades at NSE. You can reach the Chartist here mail@niftynext.com . We are Using Ami Broker Charting Software ( V-5.51 ) ,Pattern Explorer & Ami Tool-Power Scan.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT-TOP68 STOCKS FOR 18 MAY2012

| STOCKS/SCRIPS™ WWW.NIFTYNEXT.COM | TRENDS |

| SBIN | |

| TATAMOTORS | |

| BAJAJ-AUTO | |

| ICICIBANK | |

| LT | |

| RELIANCE | |

| | |

| | |

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

NIFTY NEXT- INDIAN RUPEE 5 MINS TECHNICAL PRICE CHART 18 MAY 2012

INDIAN RUPEE is now Trading at ` 54.4850 Up by 0.1300(0.2392%) at 7:52AM against US Dollar. On 5 Mins Technical Chart, Indian Rupee has now Strong Resistance at `54.5459 and Support at` 54.2719 on Intraday Basis.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

Thursday, May 17, 2012

NIFTY NEXT- Nifty Trading Range for 17 May 2012

Nifty-Spot Today(17 May 2012) will Trade with Flat to Negative Note within the Range of 4871-4834.As per Our NNI-Nifty Next Indicator, which has Declined in Last Trading Sessions also suggest the Same Bearishness for the Index. On Technical Price Chart, Major Momentum Indicators are in Bearish Zone. If Nifty-Spot Today(17 May2012) closes below 5844.95 levels, then Index Will Slide Further to Lower Levels of 4738/4508 in Short Term.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based quant Research Firm, M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks, trades at NSE. You can reach the Chartist here mail@niftynext.com . We are Using Ami Broker Charting Software ( V-5.51 ) ,Pattern Explorer & Ami Tool-Power Scan.

Call NiftyNext # +91 80171 98633 Or SMS NiftyNext @ 880 2230 836 For Paid Calls or Email at MAIL@NIFTYNEXT.COM Know More About Your Packages For Best Performance in Stocks Markets @ http://bankniftynext.blogspot.com

HINDALCO-A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

HINDALCO Closes at `110.30 with a Fall of -3.50% on 16 May 2012 with formation of a Black Candle on Daily Price Chart .Technically, HINDALCO is looking Weak on Charts. It is now Trading Below Its 200DMA. Schaff Trend Cycle is also Negative. Major Momentum Indicators are also Bearish. It has also Broken the Downside of Linear Regression Line, Making it Short/Mid Term Bearish.

We Recommend to SELL: HINDALCO at CMP

Target : `104.67/100

Stop: Loss :`115.53

Time Frame: 5-20 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

RELINFRA-A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

RELINFRA Closes at `452.05 with a Fall of -3.60% on 16 May 2012 with formation of a Black Candle on Daily Price Chart .Technically, RELINFRA is looking Weak on Charts. It is now Trading Below Its 200DMA. Schaff Trend Cycle is also Negative. Major Momentum Indicators are also Bearish. It has also Broken the Downside of Linear Regression Line, Making it Short/Mid Term Bearish.

We Recommend to SELL: RELINFRA at CMP

Target : `425.43/416.09

Stop: Loss :`453.45

Time Frame: 5-20 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

HDFC-A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

HDFC Closes at `620.90 with a Fall of -3.80% on 16 May 2012 with formation of a Gap Down Candle on Daily Price Chart .Technically, HDF Cis looking Weak on Charts.It is now Trading Below Its 200DMA. Schaff Trend Cycle is also Negative. Major Momentum Indicators are also Bearish. It has also Broken the Downside of Linear Regression Line, Making it Short/Mid Term Bearish.

We Recommend to SELL: HDFC at CMP

Target : `604.25/601.54/593.50

Stop: Loss :`626.25

Time Frame: 5-20 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

TATA STEEL -A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

TATA STEEL Closes at `400.60 with a Fall of -4.20% on 16 May 2012 with formation of a Long Black Candle on Daily Price Chart .Technically, TATA STEEL is looking Weak on Charts.It is now Trading Below Its 200DMA. Schaff Trend Cycle is also Negative. Major Momentum Indicators are also Bearish. It has also Broken the Downside of Linear Regression Line, Making it Short/Mid Term Bearish.

We Recommend to SELL: TATA STEEL at CMP

Target : `78.75/66.00

Stop: Loss :`85.85

Time Frame: 5-20 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

SAIL -A MultiBagger,Buy/Sell/Hold,Growth Pospects and Recomendation,News and Results,Target Price and Analysis,Views and Outlook,Hot Stocks/Picks

SAIL Closes at `84.60 with a Fall of -4.50% on 16 May 2012 with formation of a Black Opening Marubozu Candle on Daily Price Chart .Technically, is looking Weak on Charts. Major Momentum Indicators are also Bearish. Trend Score is Turning Negative.

We Recommend to SELL: SAIL Below `83.06

Target : `78.75/66.00

Stop: Loss :`85.85

Time Frame: 5-20 Trading Days

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

Editor’s Note : This Article is written by Vina S Singh, Senior Chartist at www.niftynext.com , which is a Technically Based Quant Research Firm at M/S Durgapur Holdings in Durgapur, West Bengal, India that covers all Stocks(Trades at NSE) & In-Depth Analysis of Indian Equity Market,Major World Indicies,Bonds,ETFs. We use Ami Broker Charting Software (V-5.50),Pattern Explorer & AmiTools-Power Scan(V-1.3.6).You can reach the Chartist here mail@niftynext.com Or Over Phone at +91 80171 98633 begin_of_the_skype_highlighting +91 80171 98633 end_of_the_skype_highlighting Or SMS at +91 880 2230 836/ 8927670565.

Subscribe to:

Posts (Atom)

Disclaimer

The recommendations made herein do not constitute an offer to sell or a solicitation to buy any of the securities mentioned. No representations can be made that the recommendations contained herein will be profitable or that they will not result in losses. Readers using the information contained herein are solely responsible for their actions. Information is obtained from sources deemed to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on the theory of Technical Analysis and do not reflect the fundamental validity of the Scrip. www.niftynext..com does 't take any Responsibility for any losses arising from using the Stocks Recommendations.

We( WWW.NIFTYNEXT.COM) are not Registered with Any Regulatory Body in India ie SEBI,NSE,BSE,AMFI or Any Otheres.

Blog Archive

-

▼

2012

(355)

-

▼

May

(82)

- FII DATA Updates for 30 April 2012

- NIFTY NEXT-TOP 7 STOCKS FOR 02 MAY2012

- NIFTY NEXT- Nifty Trading Range for 02 May 2012

- FII Data Updates For 02 May 2012

- NIFTY NEXT- INDIAN RUPEE 5 Mins Technical Chat 02 ...

- NIFTY NEXT- Nifty EOD 02 May 2012 Technical Analys...

- NIFTY NEXT-TOP 8 STOCKS FOR 03 MAY2012

- NIFTY NEXT- Nifty Trading Range for 03 May 2012

- FII DATA Updates for 03 May 2012

- NIFTY NEXT- NIFTY-II-CE-6500 JUNE 2012 SERIES CHART

- NIFTY NEXT-TOP 8 STOCKS FOR 04 MAY2012

- NIFTY NEXT- Nifty Trading Range for 04 May 2012

- NIFTY NEXT- INDIAN RUPUEE-US DOLLAR 10 Mins Techni...

- NIFTY NEXT- Nifty Daily Technical Chart 04 May 2012

- NIFTY NEXT-TOP 8 STOCKS FOR 07 MAY2012

- NIFTY NEXT- Nifty Trading Range for 07 May 2012

- NIFTY NEXT- Nifty EOD 07 May 2012 Technical Analys...

- NIFTY NEXT- NIFTY PE Chart 07 MAY 2012

- NIFTY NEXT- NIFTY-SPOT 5 MINS TECHNICAL PRICE CHAR...

- NIFTY NEXT- Nifty EOD 08 May 2012 Technical Analys...

- IPO Of PLASTENE INDIA LIMITED.

- NIFTY NEXT-TOP 8 STOCKS FOR 09 MAY2012

- NIFTY NEXT- Nifty Trading Range for 09 May 2012

- NIFTY NEXT- INDIAN RUPEE/US DOLLAR 5 Mins Technica...

- NIFTY NEXT-TOP 8 STOCKS FOR 10 MAY 2012

- NIFTY NEXT- Nifty Trading Range for 10 May 2012

- NIFTY NEXT- Nifty Will Slide Further on 11 May 20...

- NIFTY NEXT- Nifty Trading Range for 11 May 2012

- Nifty Next- Nifty Spot 1Mins Technical Price Chart...

- NIFTY NEXT- Nifty EOD 15 May 2012 Technical Analys...

- NIFTY NEXT- GOLD-I Technical Price Chart & Target ...

- NIFTY NEXT- CRUDEOIL-I Technical Price Chart & Tar...

- NIFTY NEXT- SILVER-I Technical Price Chart & Targ...

- RANBAXY-A MultiBagger,Buy/Sell/Hold,Growth Pospect...

- ASIANPAINT-A MultiBagger,Buy/Sell/Hold,Growth Posp...

- CAIRN-A MultiBagger,Buy/Sell/Hold,Growth Pospects ...

- NIFTY NEXT- Nifty Trading Range for 15 May 2012

- IPO Name: SPECIALITY RESTAURANTS LIMITED.

- NIFTY NEXT- Nifty EOD 16 May 2012 Technical Analys...

- BPCL-A MultiBagger,Buy/Sell/Hold,Growth Pospects a...

- KOTAKBANK-A MultiBagger,Buy/Sell/Hold,Growth Pospe...

- POWERGRID-A MultiBagger,Buy/Sell/Hold,Growth Pospe...

- BANKBARODA-A MultiBagger,Buy/Sell/Hold,Growth Posp...

- CAIRN-A MultiBagger,Buy/Sell/Hold,Growth Pospects ...

- STERLITEIN-A MultiBagger,Buy/Sell/Hold,Growth Posp...

- BAJAJ AUTO -A MultiBagger,Buy/Sell/Hold,Growth Pos...

- DRREDDYSLA(DRREDDY)-A MultiBagger,Buy/Sell/Hold,Gr...

- MAH&MAH(M&M)-A MultiBagger,Buy/Sell/Hold,Growth Po...

- TATA MOTOR-A MultiBagger,Buy/Sell/Hold,Growth Posp...

- SAIL -A MultiBagger,Buy/Sell/Hold,Growth Pospects ...

- TATA STEEL -A MultiBagger,Buy/Sell/Hold,Growth Pos...

- HDFC-A MultiBagger,Buy/Sell/Hold,Growth Pospects a...

- RELINFRA-A MultiBagger,Buy/Sell/Hold,Growth Pospec...

- HINDALCO-A MultiBagger,Buy/Sell/Hold,Growth Pospec...

- NIFTY NEXT- Nifty Trading Range for 17 May 2012

- NIFTY NEXT- Nifty EOD 17 May 2012 Technical Analys...

- NIFTY NEXT- INDIAN RUPEE 5 MINS TECHNICAL PRICE CH...

- NIFTY NEXT-TOP68 STOCKS FOR 18 MAY2012

- NIFTY NEXT- Nifty Trading Range for 18 May 2012

- NIFTY NEXT- Nifty Trading Range for 21 May 2012

- NIFTY NEXT- Nifty EOD 21 May 2012 Technical Analys...

- NIFTY NEXT- NIFTY PE Chart 21 May 2012

- NIFTY NEXT- Nifty Trading Range for 22 May 2012

- NIFTY NEXT- Nifty EOD 22 May 2012 Technical Analys...

- AmiQuote 3.03 released on MAY 22, 2012

- NIFTY NEXT- Nifty Trading Range for 23 May 2012

- NIFTY NEXT- Nifty EOD 23 May 2012 Technical Analys...

- NIFTY NEXT- INDIAN IS now Trading at `55.95 agains...

- NIFTY NEXT- INDIAN RUPEE 5 Mins Technical Price Ch...

- NIFTY NEXT- Dow Jones Industrial Average (^DJI) Te...

- GAIL-A MultiBagger,Buy/Sell/Hold,Growth Pospects a...

- BHARTIARTL-A MultiBagger,Buy/Sell/Hold,Growth Posp...

- RANBAXY -A MultiBagger,Buy/Sell/Hold,Growth Pospec...

- COALINDIA-A MultiBagger,Buy/Sell/Hold,Growth Pospe...

- NIFTY NEXT- Nifty Trading Range for 24 May 2012

- NIFTY NEXT- Nifty EOD 24 May 2012 Technical Analys...

- NIFTY NEXT- INDIAN RUPEE Technical Chart 25 May 2012

- NIFTY NEXT- GOLD Price Target and Technical Chart

- NIFTY NEXT- Nifty Trading Range for 25 May 2012

- NIFTY NEXT-TOP 8 STOCKS FOR 28 MAY2012

- NIFTY NEXT- Nifty Trading Range for 28 May 2012

- NIFTY NEXT- Nifty EOD 28 May 2012 Technical Analys...

-

▼

May

(82)