We have tried to find out the valuation of the Varroc Engineering Ltd. using EPV method ( Earning Power Value ). At the offer price of Rs.965, it is valued 16.5X , which is quite higher compare to other OME. Kindly note that Motherson Sumi Systems Ltd is now Trading at ~3.5X of its EPV ( March 2018 earning basis ).We have taken the estimates of the Varron Engg from a reputed broking firm's note.

Tuesday, June 26, 2018

Varroc Engineering Ltd. : Valuations

We have tried to find out the valuation of the Varroc Engineering Ltd. using EPV method ( Earning Power Value ). At the offer price of Rs.965, it is valued 16.5X , which is quite higher compare to other OME. Kindly note that Motherson Sumi Systems Ltd is now Trading at ~3.5X of its EPV ( March 2018 earning basis ).We have taken the estimates of the Varron Engg from a reputed broking firm's note.

Sectors with Highest Operating Profit Margin Growth in Q4/ FY 2017-18

2/3 Wheelers, Leisure Facilities,Oil Equipment & Services, Department Stores & Household Appliances sectors has seen highest YoY OPM Growth.

Join Us at WhatsApp: 1 . https://chat.whatsapp.com/6LfcMS38vjdFt5xYGwS73J ( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

# We are active at Twitter # NIFTYNEXT1

Sunday, June 24, 2018

Sugar Cycle & Bottom Out

Sugar Cycle is to find its Bottom soon. ~10% correction is

expected. Datamined since 1961.Suger stocks may correct ~30-35% to bottom out.

Join Us at WhatsApp: 1 . https://chat.whatsapp.com/6LfcMS38vjdFt5xYGwS73J ( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

# We are active at Twitter # NIFTYNEXT1

Saturday, June 23, 2018

Capacit'e Infraprojects Ltd ( CAPACITE ) - A MultiBagger, Buy/Sell/Hold, Growth Prospects and Recommendation, News and Results, Target Price and Analysis, Views and Outlook, Hot Stocks/Picks

CAPACITE closes

at ₹ 282.8 with a Fall of -2.10 % on 22-June

-2018 with formation of a small red

Candle on Daily Price Chart. Technically, CAPACITE is consolidating phase and finding its support

at the lower levels.

Valuations : CAPACITE

is now Trading at 2.7X of its EPV (

March 2018 earnings ). Its 10 years avg. long term EPV comes at 2X, which

translates its effective price at ₹ 209.50. It has Net Cash / Share of ₹ 13.. Market Cap / Networth is 6.5X. Roe is 30% & RoCE is 16%

We may

BUY / Accumulate CAPACITE at CMP ( ^ Better to accumulate at ₹ 209

in downtrend )

Target : ₹ 650 *Stock Price Target(PE Expansion Formula )

Stop: Loss : ₹ Accmulations Basis

Time Frame: 36 Months

Financials

: https://www.screener.in/company/CAPACITE/

Disclaimer

: We are / may going to take exposure shortly.

Join Us

at WhatsApp: 1 . https://chat.whatsapp.com/6LfcMS38vjdFt5xYGwS73J ( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

# We

are active at Twitter # NIFTYNEXT1

Saturday, June 16, 2018

Valiant Communications Ltd ( 526775 ) – A Multi Bagger, Buy/Sell/Hold, Growth Prospects and Recommendation, News and Results, Target Price and Analysis, Views and Outlook, Hot Stocks/Picks

Valiant Communications Ltd closes at ₹ 54.25 with a Gain of

+13.0 %

on 15-June- -2018 with formation of

a Long Green Candle on Daily Price Chart.

Valuations :

Valiant Communications has

received the orders/ contract to supply and

commissioning of its communication solutions from the Transmission

Corporation of Andhra Pradesh, Kerala State Electricity Board and Tejas

Networks. The total value of the orders is ₹12.56 crore; it

has to be executed in the current financial year.

Valiant Communications Ltd is now Trading at 2.5 X of its EPV ( March

2018 earnings ) with a -48% deep discount to its 10yrs long term EVP . Its

Price at the Long Term avg comes around ₹80.40

Financials

: https://www.screener.in/company/526775/

Disclaimer : We are / may going to take exposure

shortly.

Join Us at

WhatsApp: 1. https://chat.whatsapp.com/6RaxJrOD5UzFi1uw0hgBCo ( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

Wednesday, June 13, 2018

Textile & Apparel Exports Negative News

Cotton prices are in Bull phase with closing stocks at 6-yrs low in India. As per reliable sources, Cotton will have closing balance of 16 L bales in 2017-18 compare to 30L bales in 2016-17 and price will move upto Rs.54000 per candy from present Rs.49000.There is a huge demand from millers & exporters this year as domestic demand has seen ~10% increase.We may avoid these sector in coming days.

Join Us at WhatsApp: 1. https://chat.whatsapp.com/6LfcMS38vjdFt5xYGwS73J ( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

Tuesday, June 12, 2018

Housing Finance & Realty Sector Updates

Housing

Finance & Realty Sector cos. Mainly engaged

in Affordable Housing sector is Gaining teeth slowly. Though rising interest rates

will affect their PAT in coming days, but the Opportunities ahead is

exponential. Reality market has started recovery.

Stocks related to these sectors are now available at a Reasonable Valuations. We

are expecting an up-move in short term.

Join Us at WhatsApp:

1. https://chat.whatsapp.com/6LfcMS38vjdFt5xYGwS73J

( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

Monday, June 11, 2018

Sanghi Industries Ltd ( SANGHIIND ) – Managements View & Valuations

Managements View : *Cement

prices steady in April & May 2018 vs Q4FY18

*Expect

a regular cement price cut of 3%/5% during monsoon

*FY19 tgt vols=3.2mt & EBITDA exp at apprx

900/tn

*Blended costs of borrowing down to 10.75% vs

15.5% earlier

*Capacity wil double by March 2020

( Source : CNBCTV18 )

Valuations

: Sanghi

Industries Ltd is now Trading at 2.3X of its EPV ( March 2018 earnings ). Its

10 years avg. long term EPV comes at 3.3X, which translates its effective price

at ₹ 123.50. It

has Net Cash / Share of ₹ 0.70. Market Cap / Networth is 1.9X.

Financials : https://www.screener.in/company/SANGHIIND/

Disclaimer

: We are / may going to take exposure shortly.

Join Us at WhatsApp:

1. https://chat.whatsapp.com/6LfcMS38vjdFt5xYGwS73J

( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

Sunday, June 10, 2018

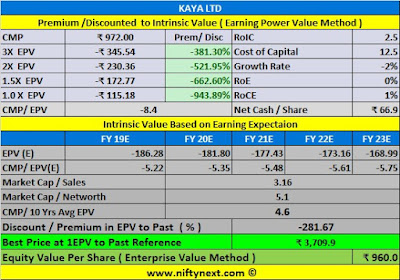

Kaya Ltd ( KAYA ) – Valuations

KAYA closes

at ₹ 972.95 with a Gain of +9.2% on 08-June-

-2018 with formation of a Long Green Candle

on Daily Price Chart.

Valuations

: Sales has declined to 97.38Cr by

-2.94% in Q4 FY 2017-18 & Losses has inched higher to -7.84 Cr. By-102%.

Kaya Ltd is now

Trading at -8.4X of its EPV ( March 2018 earnings ). Its 10 years avg. long

term EPV comes at 4.6x, which translates its effective price at ₹ 3709. It has

Net Cash / Share of ₹ 66.90. Market Cap / Networth is 5.1X. Raw Material Consumed has increased by+38% to

₹ 9.99 Cr & Stock

has Adjustments of ₹ -0.15 Cr ( In previous Quarter YoY it was ₹ 5.11Cr ). R&D Expenses is Zero in the

last FY 2017-18 while Employee Expenses is ₹ 35.77 Cr declined by -3% QoQ.

Disclaimer

: We are / may going to take exposure shortly.

Join Us at WhatsApp:

1. https://chat.whatsapp.com/6RaxJrOD5UzFi1uw0hgBCo ( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

Wednesday, June 6, 2018

Biocon Ltd ( BIOCON ) – Valuations

BIOCON closes

at ₹ 608.2 with a Gain of +0.1% on 06-June-

-2018 with formation of a small Green Candle

on Daily Price Chart.

Valuations

: BIOCON’s Biopharma is key driver for growth which is expected to

grow at a rate of 36% CGAR from 2018-2020 & EPS from 5.3 to 36.4 . It is

now Trading at 11.9X of its EPV ( March 2018 earnings ) Its 10 years avg. long

term EPV comes at 7.3, which translates its effective price at ₹ 373.00. It has Net Cash / Share of Rs.114.90

Disclaimer

: We are / may going to take exposure shortly.

Join Us at WhatsApp: 1. https://chat.whatsapp.com/6RaxJrOD5UzFi1uw0hgBCo ( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

Monday, June 4, 2018

Jocil Ltd : Q4 FY2017-18 Results Update & Valuations

Jocil Ltd has turned-around in Q4 FY2017-18. It has reduced Other Expenses by -20% and Raw Material Consumed by -47%, which lead to Increase the Profitability in subdued sales (-31%) QoQ.

Join Us at WhatsApp: 1 . https://chat.whatsapp.com/83QrAlotPlPJkDrNKqdoFI ( Free )

We are active at Twitter # NIFTYNEXT1

Friday, June 1, 2018

Sugar Sector Update

Cultivation of Sugercane has incresed to 4.87 million hectarers than 4.79 million hectarers in 2017. Farmers are having Rs. 200 Billion delayed payments from the mills for the current harvest.Next marketing year will start with carry forward stocks of 11 million tonnes .Govt's support to export Sugar to Internation market is being questioned by Brazil & Australia in for violation of WTO restrictions.All these will have negative Impact on the Sugar Stocks.

Join Us at WhatsApp: 1. https://chat.whatsapp.com/6RaxJrOD5UzFi1uw0hgBCo ( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

Subscribe to:

Posts (Atom)

Disclaimer

The recommendations made herein do not constitute an offer to sell or a solicitation to buy any of the securities mentioned. No representations can be made that the recommendations contained herein will be profitable or that they will not result in losses. Readers using the information contained herein are solely responsible for their actions. Information is obtained from sources deemed to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on the theory of Technical Analysis and do not reflect the fundamental validity of the Scrip. www.niftynext..com does 't take any Responsibility for any losses arising from using the Stocks Recommendations.

We( WWW.NIFTYNEXT.COM) are not Registered with Any Regulatory Body in India ie SEBI,NSE,BSE,AMFI or Any Otheres.

Blog Archive

-

▼

2018

(269)

-

▼

June

(14)

- Sugar Sector Update

- Jocil Ltd : Q4 FY2017-18 Results Update & Valuations

- Biocon Ltd ( BIOCON ) – Valuations

- Kaya Ltd ( KAYA ) – Valuations

- Sanghi Industries Ltd ( SANGHIIND ) – Managements...

- Housing Finance & Realty Sector Updates

- Textile & Apparel Exports Negative News

- Dish TV India Ltd : Valuations & Price Target

- Valiant Communications Ltd ( 526775 ) – A Multi ...

- Industry-Wise Q4 FY 2017-18 Performance

- Capacit'e Infraprojects Ltd ( CAPACITE ) - A Mul...

- Sugar Cycle & Bottom Out

- Sectors with Highest Operating Profit Margin Growt...

- Varroc Engineering Ltd. : Valuations

-

▼

June

(14)