Housing

Finance & Realty Sector cos. Mainly engaged

in Affordable Housing sector is Gaining teeth slowly. Though rising interest rates

will affect their PAT in coming days, but the Opportunities ahead is

exponential. Reality market has started recovery.

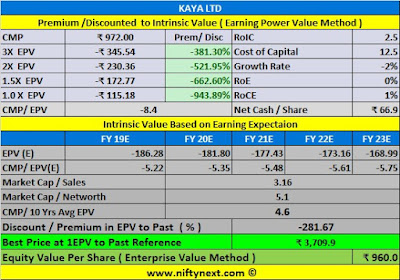

Stocks related to these sectors are now available at a Reasonable Valuations. We

are expecting an up-move in short term.

Join Us at WhatsApp:

1. https://chat.whatsapp.com/6LfcMS38vjdFt5xYGwS73J

( Free )

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1

2. https://chat.whatsapp.com/8sR3MYOXvSFIIa56Tc7Ush (Premium )

$$$ We are active at Twitter # NIFTYNEXT1